Porto Seguro (B3: PSSA3): a clear-cut investment opportunity

Opinion: Porto Seguro ("Porto") is the best company listed on B3

I have been a long-time investor in Porto Seguro, though I can’t recall exactly when I made my first investment in the company.

In my opinion, Porto Seguro ("Porto") is the best company listed on B3 (the Brazilian Stock Exchange). Of course, this is a personal view, but one that I strongly believe in.

Porto Seguro (B3: PSSA3) is Brazil’s leading insurance company, with a dominant presence across the country. Over the years, the company has expanded beyond traditional insurance into finance, health, credit cards, rent guarantee insurance, and group savings plans.

Porto Seguro’s history is deeply connected with the growing insurance culture in Brazil. It is the most recognized brand in the market and currently serves around 13 million customers.

Despite its long-standing tradition, the company maintains a forward-thinking and innovative approach.

Business segments: a comprehensive portfolio

Porto Seguro (PSSA3) is primarily engaged in the automobile insurance sector, but its operations span across six key business segments:

Car Insurance – Offering a wide range of automobile insurance products;

Health Insurance & Plans – Providing health and dental insurance policies and healthcare plans;

Life Insurance & Pension Plans – Managing life insurance products and pension plans;

Other Insurance – Covering additional non-life insurance policies;

Financing – Engaged in credit transactions and credit card services;

Other Products – Including insurance services in Uruguay, electronic protection, surveillance, and automotive parts distribution.

In addition, the company offers a range of services not related to insurance activity, such as electronic protection and surveillance and distribution of automotive parts.

A Strategic Partnership with Itaú (NYSE: ITUB)

Founded in 1945 by a group of entrepreneurs, Porto Seguro has continued to grow as a modern and dynamic company. It actively seeks mergers and acquisitions, experiments with new business initiatives, and quickly adapts when needed.

The company’s leadership is also a major strength. The current CEO, Paulo Kakinoff, is widely regarded as one of Brazil’s top executives.

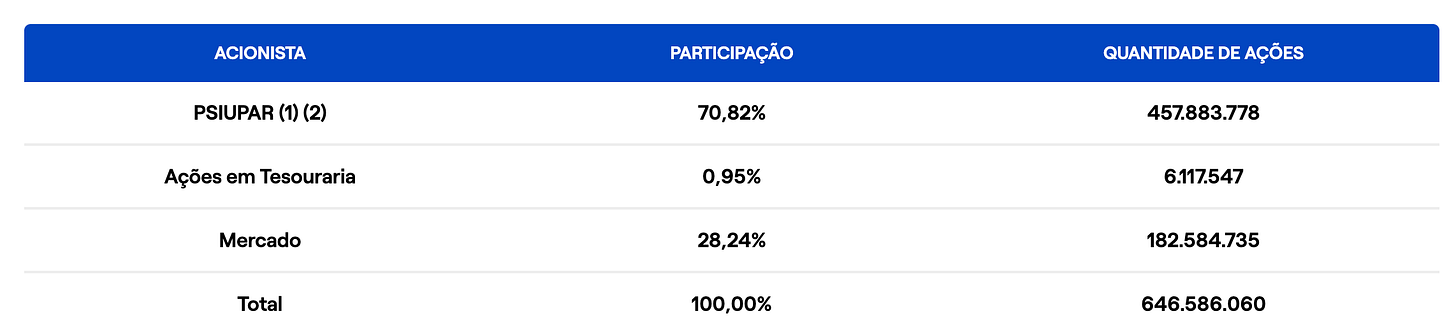

Porto Seguro's primary shareholder is PSIUPAR—a holding company controlled by the Jayme Brasil Garfinkel family and Itau Unibanco NYSE:ITUB—which owns 70.82% of the shares. For me, investing in a company with such high-quality shareholders presents an attractive asymmetry of risk and reward.

Additionally, Artica, an investment firm that I trust, has also invested in Porto Seguro—another signal of the company’s strong potential.

Consistent Earnings and Predictable Growth

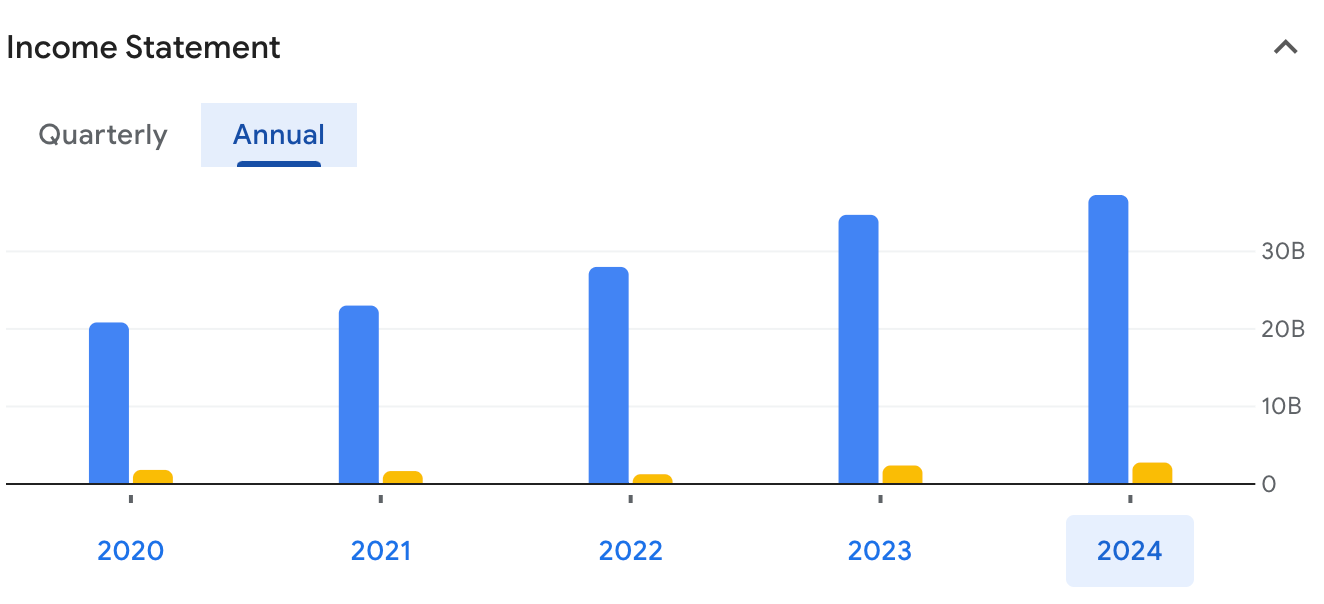

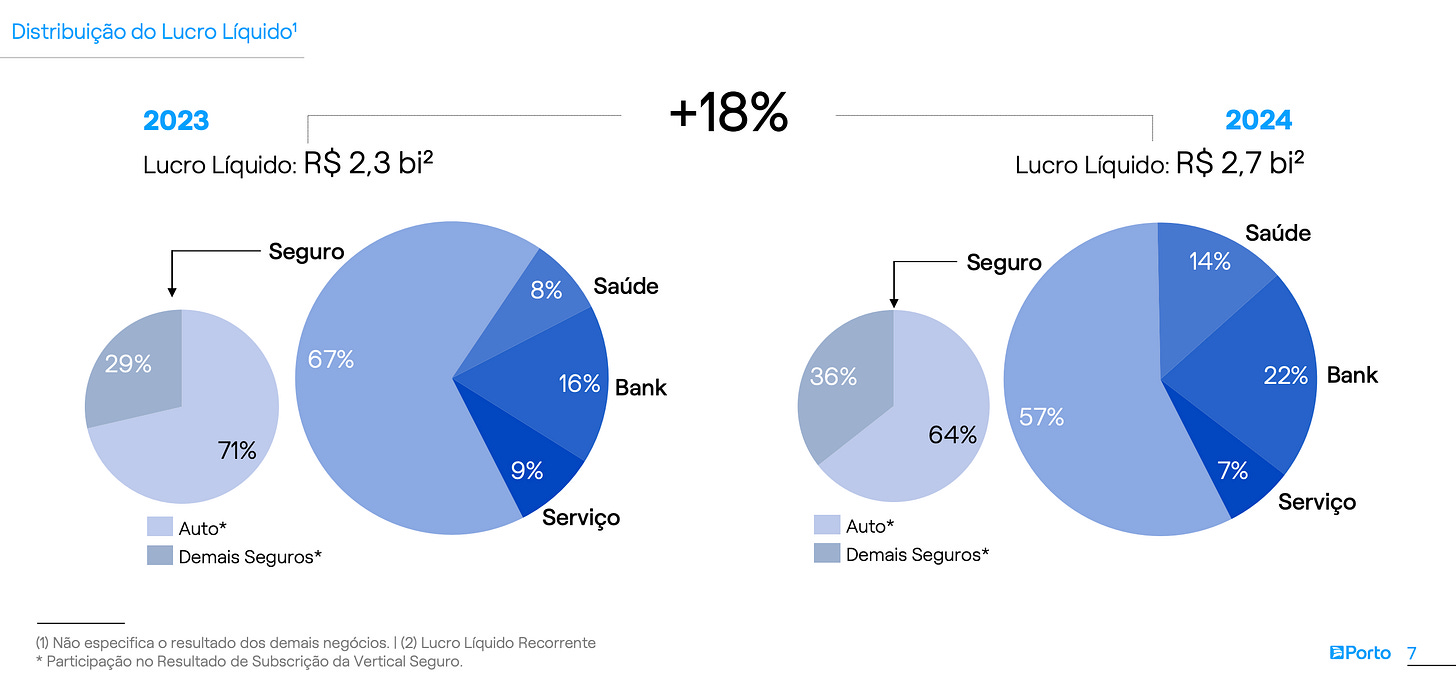

Recently, Porto Seguro released its 2024 financial results:

Total revenue: BRL 37 billion (a 13% increase from the previous year);

Recurring net income: BRL 2.7 billion (an 18% increase);

Market capitalization: BRL 25 billion (as of February 26, 2025).

Porto Seguro's consistent growth is remarkable, and its 2025 guidance remains encouraging.

Three Key Reasons Why I Continue to Invest in Porto Seguro

So, I have three important motivations to continue investing in Porto Seguro and still believing in their future vision.

1. The Health Insurance Segment: A Hidden Gem

Porto Seguro’s health insurance division is expanding rapidly, doubling in size year after year. Brazil presents a significant growth opportunity in this sector, as Porto currently ranks only 9th in market share.

Top health insurers in Brazil (2023)

Bradesco SaúdeHapvidaAmérica SaúdeAmilUnimed NacionalPrevent SeniorUnimed Belo HorizonteUnimed SaúdePorto Seguro Saúde

Unimed Porto Alegre

UBS BB has estimated the value of Porto’s health business at up to BRL 6.5 billion (USD 1.1 billion)—a testament to its untapped potential.

2. Strong Performance in High-Interest Rate Environments

In Brazil’s high-interest-rate scenario, Porto Seguro benefits from customer prepayments, which provide the company with a significant financial edge. Many insurance plans in Brazil are prepaid, allowing Porto to generate returns on its float.

With the Selic rate at 13.25% per year, Porto Seguro continues to generate strong financial returns, even during economic downturns.

3. Market Leadership and Premium Pricing Power

Beyond its exceptional leadership team, Porto Seguro offers the best service in the insurance market. This allows the company to charge premium prices without losing market share.

The brand is highly trusted, known for its superior customer service and long-standing commitment to quality. In Brazil, insurance penetration remains low:

Only 30% of vehicles have insurance;

Just 17% of the population has life insurance;

Only 23% of Brazilians have health plans,

I continue to invest in Porto Seguro because of its: resilient and adaptive strategy, strong positioning in a vast, underpenetrated market, high-quality shareholders and management team

For me, Porto Seguro remains the best investment opportunities on B3.